You can use four steps in creating your budget. Having a budget keeps your eyes focused on the goal. You do not want to go into arrears and attract penalties. Create a plan to repay your monthly installment. You have consolidated all your debts into one.

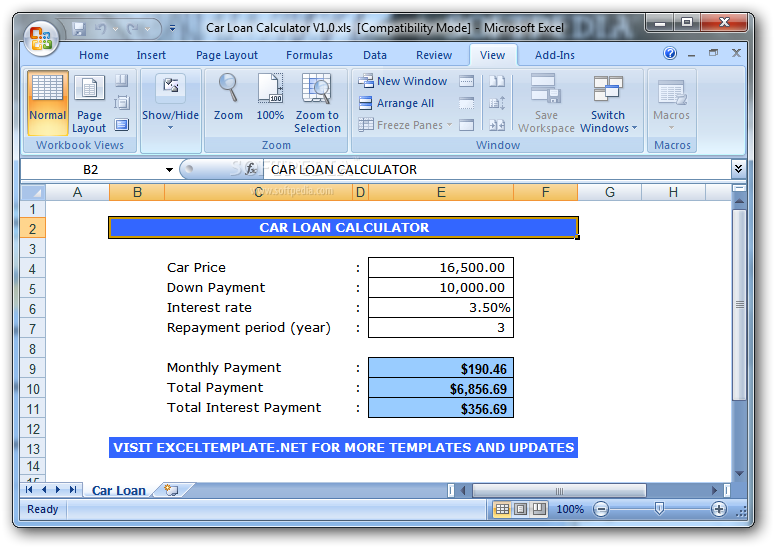

SIMPLE CAR LOAN CALC FREE

When paid within the free interest period, a balance transfer credit card could save you lots of money in interest. Many credit card issuers will allow you to transfer other debts like student loans to the credit card. Usually, it is interest-free for a limited time (mostly 12- 24 months). This is a credit card that lets you transfer existing credit balances into another account. Only consider a debt consolidation loan if the amount of interest is lower than what you are currently paying for individual debts. However, it is important to note that Debt consolidation loans have different interest rates depending on the You can take a loan to consolidate debts with high-interest rates like credit card debts. You have the option of taking out one huge loan that offers lower interest rates. It is important you understand them to choose what works best for you. There are two main methods of debt consolidation. Having many small loans means paying more interest and losing track of your debts.ĭebt Consolidation could save you a chunk of money in interest. The second step will be to consolidate all your small loans. Anything above 36% is considered an unhealthy debt load. The lower the percentage the easier it is to repay your debt. Your debt-to-income ratio will be $300- your monthly debt repayment divided by $1000-your monthly income, multiplied by 100. This ratio tells you how much of your income is used to repay debts.įor example, assume your monthly income is $1000, and use $300 to repay your debts. You can calculate your Debt-to-income ratio. Use credit reports, current statements of your bills, and bank statements to capture debt owed. List down loans from friends, family members, student loans, credit cards, mortgages, and other debts. To stay on top of things, list down everything you owe. It is easy to lose track of what you owe with several debts. Below are 5 simple steps that will get you out of debt faster.

Debt could get you overwhelmed, stressed, and feeling stuck.įortunately, with Debt management, you can get out of debt faster. Debt piles up faster as a tornado, from student loans, credit cards, and car grants to mortgages.

0 kommentar(er)

0 kommentar(er)